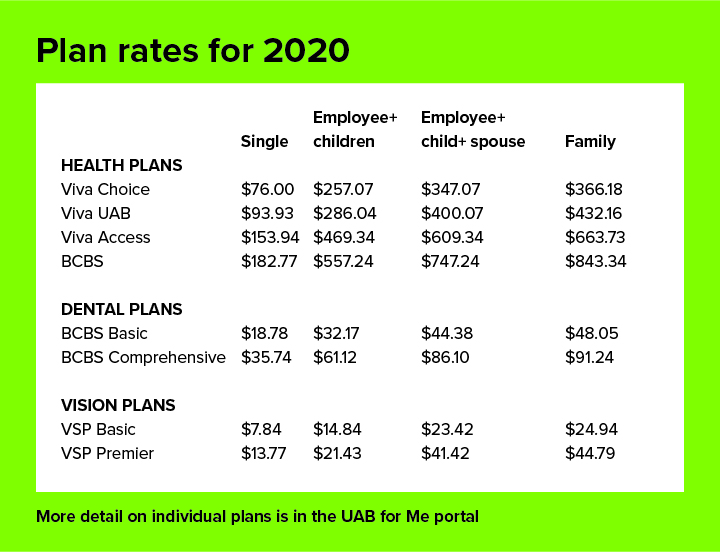

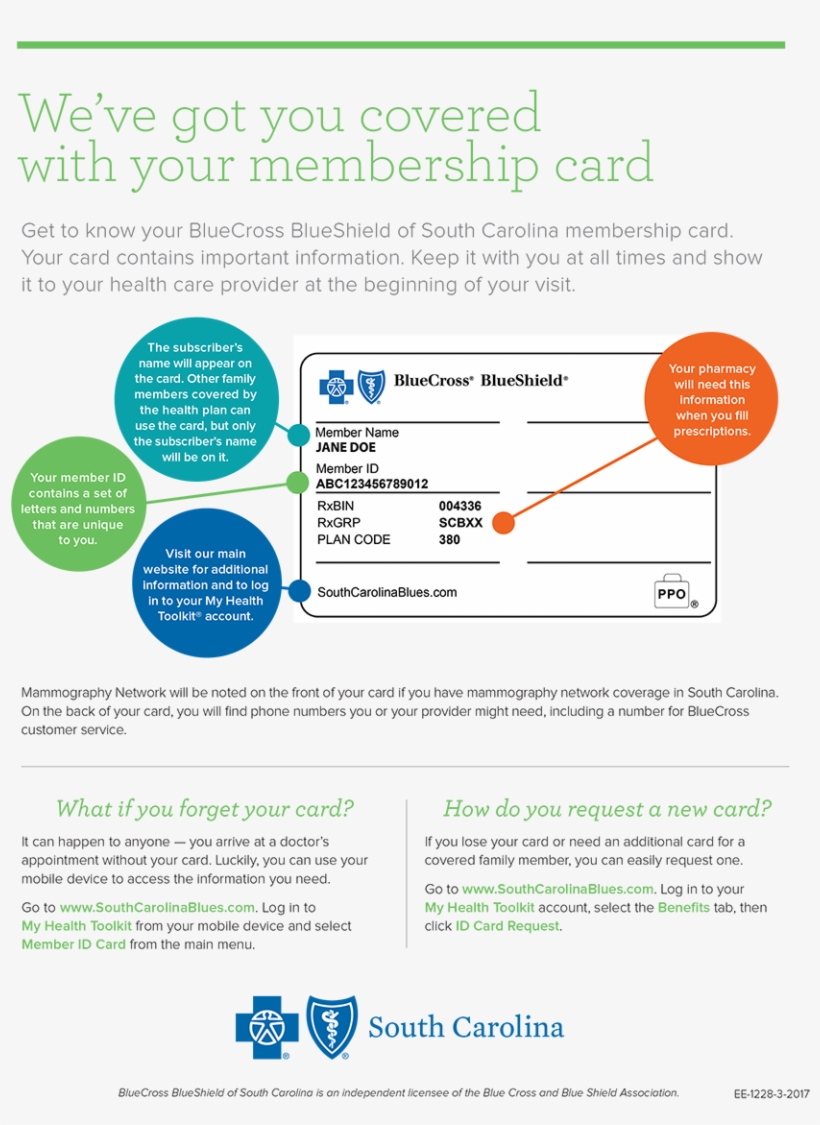

If you have questions about the services rendered, you should contact the health care provider. If you have questions, please contact Member Service at the number on the front of your ID card. First and foremost, this is a Blue Cross Blue Shield product. As a name trusted for nearly 60 years, Blue Cross and Blue Shield cares about you and your family's overall health. That's why we offer a supplemental vision plan, BCBS FEP Vision, to give you peace of mind about your family's eye health.

We offer no copays for comprehensive vision care exams and our Exclusive Collection of frames. Our provider network offers access to over 117,000 eye care providers nationwide, including top national retailers and online retailers. Whether you're beginning your first career, adding to your family, or planning for retirement, BCBS FEP Vision has you covered. When you receive a bill from your doctor, it is often for your copayment, co-insurance, or deductible. These are features of health plans, and basically have the member share in some of the cost of their health care.

For example, some health plans require that the member pay $10 for an office visit and the rest is covered by the plan. A copy of your paid receipt can take the place of the provider's signature. Patient eligibility and benefits should be verified prior to every scheduled appointment.

Eligibility and benefit quotes include membership verification, coverage status and other important information, such as applicable copayment, coinsurance and deductible amounts. It's strongly recommended that providers ask to see the member's ID card for current information and photo ID in order to guard against medical identity theft. When services may not be covered, members should be notified that they may be billed directly. Triple-S Salud offers a supplementary plan under the Federal Employee Dental Program , a different program from the Federal Employee Health Benefits .

This supplementary plan provides broad dental coverage for employees and retirees from the federal government and uniformed services retirees. Maximize your dental coverage with better benefits and lower copayments. The laser vision correction benefit allows members of BCBS FEP Vision to realize savings off the national average cost. BCBS FEP Vision has partnered with QualSight, whose laser providers are credentialed according to NCQA standards and represent ophthalmologists and surgeons who use the latest, most advanced instrumentation. When you receive Lasik surgery services with a participating provider, they will apply your benefit at the time of your visit. There is no out of network reimbursement available for Lasik surgery with BCBS FEP Vision.

To locate BCBS FEP Vision participating providers and benefit information online, please go directly to This brings you to the BCBS FEP Vision home page. You do not need to be registered to access this area of the website which provides the ability to access provider locate, benefit information, rates, health and wellness information as well as additional value add benefits. Because your PCP coordinates your care, you should always let our group know whenever you seek treatment of any kind. For further details about the specific cases that don't require a referral, please call Member Service at the number on the front of your ID card. Examples include, but are not limited to, prosthesis manufacturers, durable medical equipment suppliers, independent or chain laboratories or telemedicine providers.

A Health Care FSA is a pre-tax benefit account that's used to pay for eligible medical, dental, and vision care expenses that are not covered by your health care plan or elsewhere. With an HCFSA, you use pre-tax dollars to pay for qualified out-of-pocket health care expenses. The information provided is intended to provide general information only and does not attempt to give you advice that relates to your specific circumstances. State laws and regulations governing health insurance and health plans may vary from state to state.

Further, any information regarding any health plan will be subject to the terms of its particular health plan benefit agreement and some health plans may not be available in every region or state. All BCBS FEP Vision identification cards show only the policyholder's name. You can download an electronic ID card from the member portal or mobile app.

Though no network providers are available overseas, we do provide coverage. Your deductible is the amount you owe for health care services before your insurance begins to contribute. After you have met your deductible, you and your insurance company will share the cost of covered services. Although state and local governments have organized a number of vaccination incentive programs in recent months, this would mark the first such effort by a health insurance company. MyBlue offers online tools, resources and services for Blue Cross Blue Shield of Arizona Members, contracted brokers/consultants, healthcare professionals, and group benefit administrators. 24/7 online access to account transactions and other useful resources, help to ensure that your account information is available to you any time of the day or night.

If your plan doesn't require that you choose a PCP, you can see a specialist or other health care provider without a referral. However, you'll still need to see a provider who participates with Blue Cross Blue Shield of Massachusetts in order to have your benefits covered at the highest level. Keep it in a safe, easily accessible place like your wallet. Your card contains key information about your health insurance coverage that is required when you need care or pick up a prescription at the pharmacy.

Keeping your card in a secure location will also help protect you from medical identity theft. Any information provided on this Website is for informational purposes only. It is not medical advice and should not be substituted for regular consultation with your health care provider. If you have any concerns about your health, please contact your health care provider's office. This communication provides a general description of certain identified insurance or non-insurance benefits provided under one or more of our health benefit plans.

Our health benefit plans have exclusions and limitations and terms under which the coverage may be continued in force or discontinued. For costs and complete details of the coverage, refer to the plan document or call or write Humana, or your Humana insurance agent or broker. In the event of any disagreement between this communication and the plan document, the plan document will control.

Group health insurance and health benefit plans are insured or administered by CHLIC, Connecticut General Life Insurance Company , or their affiliates . The Cigna name, logo, and other Cigna marks are owned by Cigna Intellectual Property, Inc. John Otero is an industry practitioner with more than 15 years of experience in the insurance industry. He has held various senior management roles both in the insurance companies and insurance brokers during this span of time. He began his insurance career in 2004 as an office assistant at an agency in her hometown of Duluth, MN. He got licensed as a producer while working at that agency and progressed to serve as an office manager. Working in the agency is how he fell in love with the industry.

He saw firsthand the good that insurance consumers experienced by having the proper protection. John has diverse experience in corporate & consumer insurance services, across a range of vocations. Give the following article a thorough read to find out how to read a blue cross blue shield insurance card.

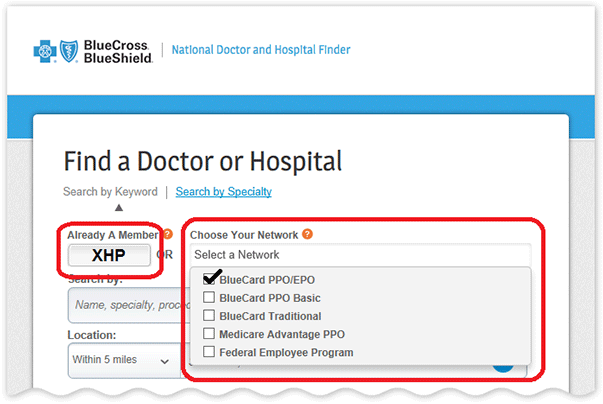

Search our online provider directory when you need a doctor, hospital or other health care provider. As a result of Massachusetts health care law, most Massachusetts residents age 18 and older are required to have health insurance. People sometimes have insurance coverage under more than one health plan, so we periodically send a survey to our members asking them if they have other coverage. This is to ensure that claims are processed correctly and that overpayments are not made. We see significant cost savings by coordinating payments with other insurers—savings that ultimately result in more affordable premiums for our members. If you have additional questions, please call Member Service at the number on the front of your ID card.

Be sure to have your ID number, health care provider's name, and the date of service handy when you call. When you and your primary care provider determine that you need specialized care, your PCP will "refer" you to a specialized provider from our trusted team. A referral is required by your HMO health plan before the plan will cover certain services. It was developed by doctors and pharmacists after careful evaluation of clinical studies to determine which medications are most effective, safe, and maximize cost savings.

Most plans, like ours, also maintain a small list of non-preferred drugs. The vast majority of the non-preferred drugs have one or more FDA-approved, covered alternatives. Our formulary allows us to offer you brand-name and generic drugs that meet your needs at a reasonable cost. Each covered member of your family may choose his or her own primary care provider , and choosing the right one is important.

There are many different types of PCPs, including general practitioners, internists, pediatricians, family medicine physicians, and nurse practitioners. To choose the best fit for you or your family member, begin by asking for recommendations from the people you trust. You should also consider each PCP's distance and accessibility from your work or home. Most importantly, talk with us to be sure that the practice can meet your personal health care needs.

If you forget or aren't sure what type of health insurance plan you have , you can find out on your BCBS ID card. If you have an HMO, your card may also list the physician or group you've selected for primary care. Determining whether a provider is in-network is an important part of choosing a primary care physician.

Highmark Blue Cross Blue Shield serves the 29 counties of western Pennsylvania and 13 counties of northeastern Pennsylvania. Highmark Blue Shield serves the 21 counties of central Pennsylvania and also provides services in conjunction with a separate health plan in southeastern Pennsylvania. Highmark Blue Cross Blue Shield West Virginia serves the state of West Virginia plus Washington County. Highmark Blue Cross Blue Shield Delaware serves the state of Delaware. Highmark Blue Cross Blue Shield of Western New York serves eight counties in Western New York and Highmark Blue Shield of Northeastern New York serves 13 counties in Northeastern New York.

Each of these companies is an independent licensee of the Blue Cross Blue Shield Association. Blue Cross, Blue Shield and the Blue Cross and Blue Shield symbols are registered marks of the Blue Cross Blue Shield Association, an association of independent Blue Cross and Blue Shield companies. MyCigna.com gives you 1-stop access to your coverage, claims, ID cards, providers, and more.

Log in to manage your plan or sign up for online access today. To view all the eye care professionals in your area, visit bcbsfepvision.com/providers. When you visit a provider who participates with both your FEHB plan and your FEDVIP plan, and the FEHB plan provides routine vision care and services, the FEHB plan will pay benefits first. The FEDVIP plan allowance will be the prevailing charge in these cases. You are responsible for the difference between the FEHB and FEDVIP benefit payments and the FEDVIP plan allowance.

We are responsible for facilitating the process with the primary FEHB payor. Each vision options is to be used independently of one another. When you have more than one health plan we need this information in order to coordinate your benefits and identify your primary and secondary plan. Acquaint yourself with what you have to do to notify us that you have two health plans. Discover a range of resources about our health care plans including sales, marketing, training and enrollment tools to help you support your clients.

Verification of eligibility and/or benefit information is not a guarantee of payment. Ever been surprised by your bill at the doctor or pharmacy? You can use the BCBSM mobile app to find out what you'll owe ahead of time.

It connects you securely to the health plan info on your bcbsm.com account when you need it. If you have your coverage through your employer, simply contact your employer's benefits office to complete the appropriate form. If you have direct-payment coverage (e.g., Access BlueSM Saver II, HMO Blue® Basic Value), call Member Service at the toll-free number on the front of your ID card. For all of our standard plans, we must receive notification within 30 days of the qualifying event. Your primary care provider is the most important part of your health care team.

With a comprehensive understanding of your medical history and conditions, your PCP will be your partner in everyday, preventive care, as well as the coordinator of any specialized care you may need. We believe collaborative relationships between you and our team of trusted, skilled doctors provide you with the best possible care. Costs for diagnostic tests and imaging services performed at hospitals or hospital-based outpatient centers are often among the highest.

Your total cost of care will be lower and your out-of-pocket costs may be lower when you have your procedure performed at an independent clinical lab or freestanding imaging center. You'll receive the same services, just at a different location. If you have an urgent health care need, call your PCP first. Your doctor will either treat you or advise you on what to do. If you have paid your premium and need to access medical care or prescriptions, but have not yet received your ID card, you can obtain the services you need. Blue Shield will work with you to ensure that your medical care or prescriptions are covered appropriately.

Your online account is a powerful tool for managing every aspect of your health insurance plan. Whether you need to check on a claim, pay a bill, or talk to a representative, you can easily access all your member features. After Arkansas Blue Cross receives a claim, it will electronically route the claim to the member's Blue Cross and Blue Shield Plan.

You'll immediately recognize BlueCard PPO members by the special "PPO in a suitcase" logo on their membership card. BlueCard PPO members are Blue Cross and Blue Shield members whose PPO benefits are delivered through the BlueCard Program. It is important to remember that not all PPO members are BlueCard PPO members, only those whose membership cards carry this logo.

Members traveling or living outside of their Blue Plan's area receive the PPO level of benefits when they obtain services from designated PPO providers. If you are an Arkansas provider, Arkansas Blue Cross is your sole necessary contact for all Blue Cross and Blue Shield claims submissions, payments, adjustments, services and inquiries . The program allows participating Blue Cross and Blue Shield providers in every state to submit claims for indemnity and PPO patients who are enrolled through another Blue Plan to their local Blue Cross and Blue Shield Plan. Our quality, affordable health plans include $0 premium options and more coverage for virtual care. We are committed to providing our members with a positive experience and personalized information and resources to meet their needs.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.