Goldman Sachs is a global investment banking, management and securities firm. Its clients have access to a variety of financial services, including banking products through Marcus, its online banking arm that made its debut in fall 2016 and began offering personal loans. Bear in mind, too, that cash in a safe deposit box isn't protected by the Federal Deposit Insurance Corporation, says Luke W. Reynolds, chief of the FDIC's Community Outreach Section. To receive FDIC insurance, which covers up to $250,000 per depositor per insured bank, your cash needs to be deposited in a qualifying deposit account such as a checking account, savings account or CD.

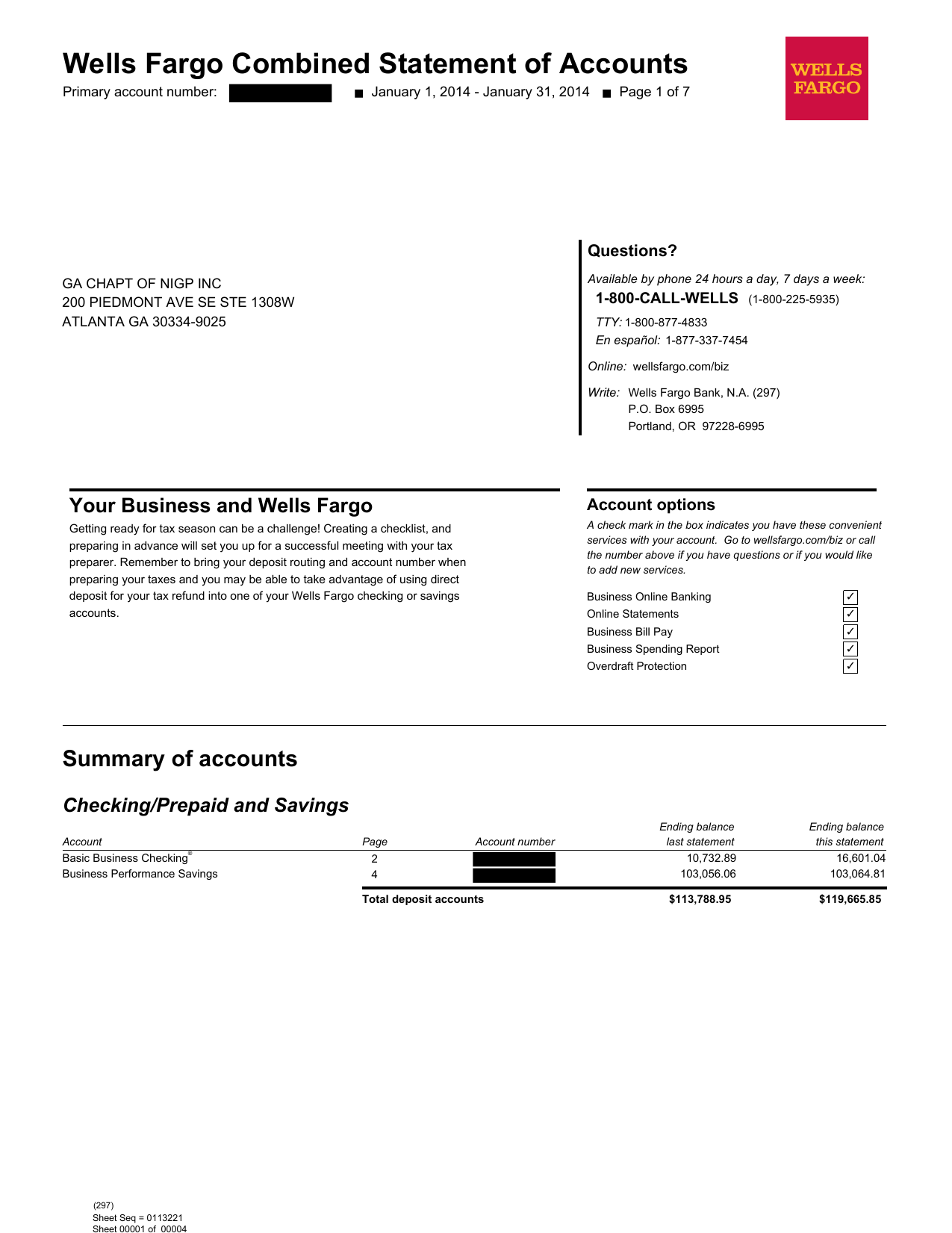

Capital One is a Fortune 500 company with subsidiaries, including Capital One Bank. Read Bankrate's review of Capital One and its online banking products. TD Bank is the U.S. commercial banking arm of Canada's TD Bank Group. Customers have access to mortgages, deposit accounts, credit cards and products for commercial and small business clients. The bank has about 1,300 branches along the East Coast and is known as "America's Most Convenient Bank" for its flexible hours. The customer service department for Wells Fargo Bank is open 24 hours a day, 7 days a week, but the Wells Fargo Bank store business hours are much different.

SBA loans are the most common means of financial access. They offer the largest amounts of cash for the lowest interest rates. You can apply for SBA loans through a bank or large financial institution. Alternatively, you can apply using a quick online process, such as through SmartBiz.

The primary disadvantage of this loan is that it's extremely hard to qualify for, with a large list of documentary requirements to satisfy. It was one of the biggest scandals in banking history, but it had little to do with the institution's investment banking or non-bank activities. It had everything to do with Wells Fargo's high-pressure sales culture and its lending practices. Access to your safe deposit box could be even more limited during emergencies, including natural disasters . The coronavirus pandemic, too, reduced operating hours for some bank branches, and limited access or required appointments for in-branch services, such as access to safe deposit boxes. Moves like that complicate your ability to retrieve important documents or items when you need them.

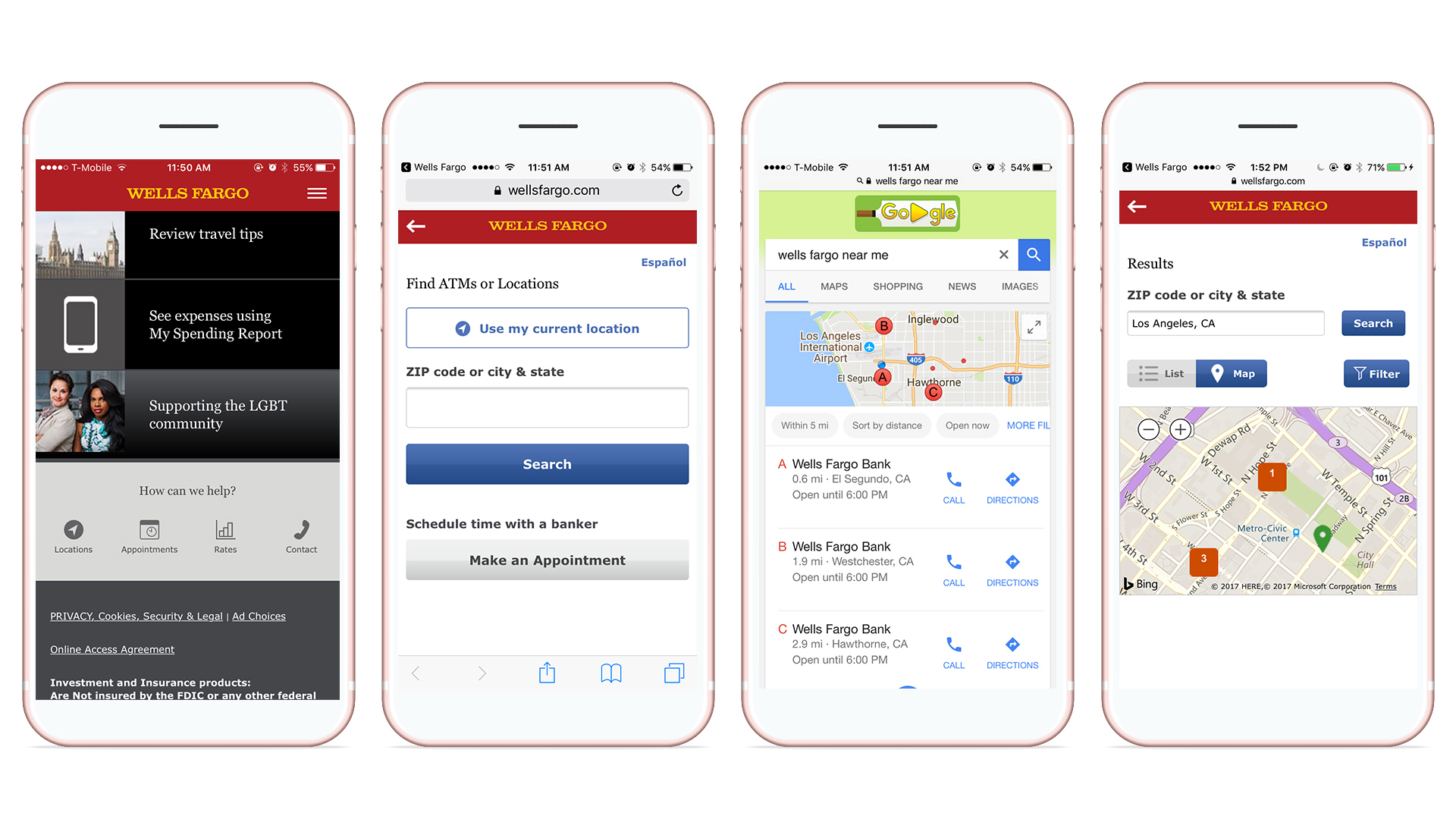

All of our San Diego County Credit Union branch locations are equipped with ATMs that accept cash and check deposits and dispense $1, $5 and $20 bills. You can also make surcharge-FREE withdrawals at over 30,000 CO-OP ATMs nationwide, including 5,500 participating 7-Eleven® locations. Save a trip with our SDCCU Mobile Deposit banking app. Are you looking for the nearest Wells Fargo bank around you?

Information about the closest Wells Fargo branches and locations can be found below, as well as the phone number of the customer service department, info about the business hours and more relevant details. Wells Fargo profited from these transactions by marking up the prices on currency it was selling to and marking down the prices on currency it was buying from its customers. These agreements, referred to internally as "fixed-pricing agreements," were both written and oral in nature. Wells Fargo Bank is a financial institution that offers customers personal and business banking. You can visit Wells Fargo Bank during normal business hours for all banking needs.

You can visit the official website [+] to learn more about Wells Fargo Bank store business hours. Digital wallet access is available at Wells Fargo ATMs for Wells Fargo Debit Cards and Wells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Some ATMs within secure locations may require a physical card for entry. Digital wallet access is available at Wells Fargo ATMs displaying the contactless symbol for Wells Fargo Debit andWells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. Some ATMs within secure locations may require a card for entry.

During the Covered Period, many FX sales specialists overcharged hundreds of commercial customers by applying larger sales margins or spreads to customer FX transactions than they represented they would. All banks set aside significant amounts of capital early on in the pandemic to prepare for what they thought could be tens of billions in loan losses. At the time, those loan-loss provisions cut into bank earnings.

Many banks likely would have experienced big losses in the first half of 2020 had it not been for the high volatility in the market, which set up a massive year for investment banking. Of the four U.S. megabanks, Wells Fargo has the smallest investment banking operation, although it is seeking to expand that unit. It also left the Great Recession with the smallest loan losses of the four, and has consistently had good credit quality. In addition, Wells Fargo's structure has gotten a lot simpler in recent months.

It announced several sales in asset management, its equipment financing business in Canada, its student lending portfolio, and its corporate trust services business. These divestments were made after management determined that the best strategy for the institution would be to focus on its core U.S. franchise. To meet aggressive sales targets, bank employees created up to 2 million accounts for credit cards and other bank offerings without customers' permission.

Certain devices are eligible to enable fingerprint sign-on. If you store multiple fingerprints on your device, including those of additional persons, those persons will also be able to access your Wells Fargo Mobile® app via fingerprint when fingerprint is enabled. Your mobile carrier's messaging and data rates may apply. ATM Access Codes are available for use at all Wells Fargo ATMs for Wells Fargo Debit and ATM Cards, andWells Fargo EasyPay® Cards using theWells Fargo Mobile® app. In a few cases, FX sales specialists provided customers false transaction data. In one instance, an FX sales specialist represented to Customer E that it would charge a spread of 5 basis points on certain BSwift wire transactions.

Contrary to this agreement, the Bank actually charged higher spreads on a series of FX transactions. Then, in email correspondence with representatives of Customer E, the FX sales specialist provided inaccurate market rate information to the customer to make the FX spread falsely appear consistent with the agreement terms. FX sales specialists internally discussed and even celebrated transactions resulting in larger FX spreads than agreed to with customers or transactions generating large FX revenue. For example, FX sales specialists on Wells Fargo's San Francisco FX desk would celebrate transactions with large spreads or sales margins by ringing a bell located on the trading floor.

Wells Fargo FX sales specialists used a variety of misrepresentations and deceptive practices to defraud customers. For example, instead of applying agreed-upon fixed spreads to customers' outgoing wires, FX sales specialists would charge inflated spreads that were as large as the FX sales specialists thought they could get away with. This practice was referred to internally as "Range of Day" Pricing. The Facebook Small Business Grants Program is offering a massive $100 Million in cash grants and advertising credits not just in the state or country, but internationally. 30,000 small businesses across 30 countries can apply.

The program is currently overwhelmed with applications, like many other incentives. Requirements are similar to Amazon – business must have a physical presence near a Facebook office and have fewer than 50 employees. Facebook has also set up a small business resource hub to help out. This is a $5,000 Tony Burch grant for women involved in business enterprises. It also offers the support that women need to advance their initiatives. In addition to the cash prize, grant winners will get a 12-month fellowship and a visit to the Tony Birch office to meet influential people and other networking opportunities.

To apply for federal grants, you typically need to have something special to offer in comparison to state or local grants. You'll also need to register through this online portal and submit the application form. If your business is involved in assisting a minority group in some way, or in helping the environment, then there are certainly going to be grants available.

Keep in mind that there are local, state, and federal grants. Many grant programs are available for those doing business in rural areas. A small business grant is a form of financial remuneration awarded once the applicant meets the criteria of the grant. The difference between a loan and a grant is that a grant does not have to be repaid, while a loan does. There are grants available for every possible field that you can think of.

Typically, they are granted to people in disadvantaged areas or from specific groups – veterans, women, Hispanics, African Americans, etc. It has been an honor to partner with and support more than 7,500 businesses in our local community with PPP loans when things were unpredictable during the height of the pandemic. Looking ahead to the future, it's a great time to check in with your banker. There are many ways we can help your business thrive and grow, and we're ready to assist you to take the next step.

As we begin to re-open Capital One branches and Cafés, you ll notice some new additions in our spaces to continue to keep our customers safe from health risks. You can still access ATMs inside branches that haven t yet reopened, and in external vestibules at both branches and Cafés. You can also access our ATMs at select Target® locations. Please use this search to check the status of locations near you.

However, if that POA is locked away in a safe deposit box that no one can access, then the person you are counting on to protect you at your time of need could find his or her hands tied. Keep the original POA with the original copy of your will, and provide copies of the POA to those who may one day need it. Leaving a letter of instruction to go along with your will is a smart estate-planning move. The letter can outline such things as whether you want to be cremated or buried, and what kind of memorial service, if any, you'd like to have. Also, a letter of instruction can include details on specific bequests – Uncle Larry gets your "Star Wars" DVD collection, Cousin Kathleen gets the pearl earrings you inherited, and so on. However, if your letter of instruction is sealed inside a safe deposit box that no one but you can access, then your final wishes might not be granted.

Open an account online to become a member.Once you are a member, apply for your credit card through Internet Branch online banking. Founded in 1792, State Street Corp. is a financial services and asset management company with around 40,000 employees and a global presence in more than 100 markets. The services it provides include investment research and trading and investment management. Its clients include asset owners, insurance companies and pension funds, among others. U.S. Bancorp is the bank holding company and parent company of U.S. What we've come to know as the fifth-largest commercial bank by assets began in 1863 as the First National Bank of Cincinnati.

Multiple mergers led to the formation of the bank known today for its extensive branch network and investment in improving its digital offerings. Its retail banking division, Citibank, is based in Sioux Falls, South Dakota. Citibank has approximately 700 branches in the U.S. and more than 1,800 branches outside of the country.

U.S. customers can also access more than 65,000 fee-free ATMs. Although the bank has focused on consolidating and eliminating branches, it still has the most branches of any bank in the country. In addition to its main app, Wells Fargo has introduced a savings app and a mobile banking app geared toward millennials.

The bank has rebranded and is focusing on repairing its fractured relationship with customers after a series of missteps. Local time (8 p.m. in Alaska) are considered received on the same day. Local time (8 p.m. in Alaska), on a bank holiday or weekend, the check deposit will be considered received the next business day. If you are a minority group or solving a specific social problem, you may be eligible for a grant program. While it might be free, you still have to put in the time to locate the correct grants and apply to them.

Wells Fargo offers a grant in nearly every state, though its Community Investment Program. The banks offer local, national, and specialized grant programs. FedEx offers one of the most well-known small business grant programs available. Unfortunately, this means that qualification chances are low. In 2018, there were 7,800 applications and 10 winners. This means that the chances of success are about 0.13%, which are not great odds.

The winner of this grant was awarded $25,000, second place got awarded $15,000, and the rest $7,500. A group of women investors came together to create 37 Angels. They recognize that just 13 percent of angel investors are women, and work to bring that to 50 percent. 37 Angels grants come with an accelerator program to bring your entire business to the next level. While the capital inflow comes in the form of an investment and not a grant, it could be just what your business needs to grow and succeed. '37 Angels' is more of a networking opportunity as opposed to an investment program.

Where possible, review how many people applied to each grant last year, and how many prize winners there were. If there were 20,000 applicants for a single prize fund of $5,000, it may not be worth it unless you have a particularly strong application. Try to gauge your chances of success and narrow down to the grants that are really worth applying for. It's definitely a good idea to investigate what kind of businesses have won in the past and see if yours is a match.

To learn about a bank, you've got to know the men and women behind it. For more than a century, Park National has helped local families, businesses and communities achieve financial success with more confidence and ease. Our heritage is firmly rooted in values of service, integrity and local community commitment. Simply insert your debit card and input your Personal Identification Number to withdraw cash, make deposits and check your account balance.

Use common sense, but remember that different banks might have different rules, so read the fine print of your bank's safe deposit box agreement. Neither document will do you much good locked away in an inaccessible safe deposit box. Make sure your medical providers, family members and health care POA have copies on hand. Or maybe you get lucky and find a good deal on a last-minute post-COVID trip to Europe. On a Friday, the flight is Saturday morning and your bank doesn't reopen until Monday.

You're out of luck if you store your passport in your safe deposit box. Some banks expressly forbid storing cash in a safe deposit box. Open an account online to become a member.Once you are a member, apply for your personal loan through Internet Branch online banking. We did not find mention of any special event Wells Fargo Bank store business hours.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.