Bank of America customer service representatives can handle a range of issues over the phone, including questions about banking services, inquiries about charges and transactions, and to check on loans and other financial products. Calling Bank of America if you suspect fraud or identity theft is often the fastest and most effective way of regaining control of your credit cards or accounts. Businesses in the Accelerated Rewards Tier have access to additional experiential rewards and a fixed point value airline travel reward. Instantly check your balances, pay bills, transfer funds, send money to friends and family, even deposit checks from your phone with KeyBank online and mobile banking. It's easy to use, secure and backed by our great customer service reps, 24/7. UBS is a premier global financial firm offering wealth management, asset management and investment banking services from its headquarters in Switzerland and its operations in over 50 countries worldwide to individual, corporate and institutional investors.

In Israel, UBS Switzerland AG is registered as Foreign Dealer in cooperation with UBS Wealth Management Israel Ltd., a wholly owned UBS subsidiary. UBS Wealth Management Israel Ltd. is a Portfolio Manager licensee which engages also in Investment Marketing and is regulated by the Israel Securities Authority. This publication is intended for information only and is not intended as an offer to buy or a solicitation of an offer. Furthermore, this publication is not intended as an investment advice and/or investment marketing and is not replacing any investment advice and/or investment marketing provided by the relevant licensee which is adjusted to each person's needs.

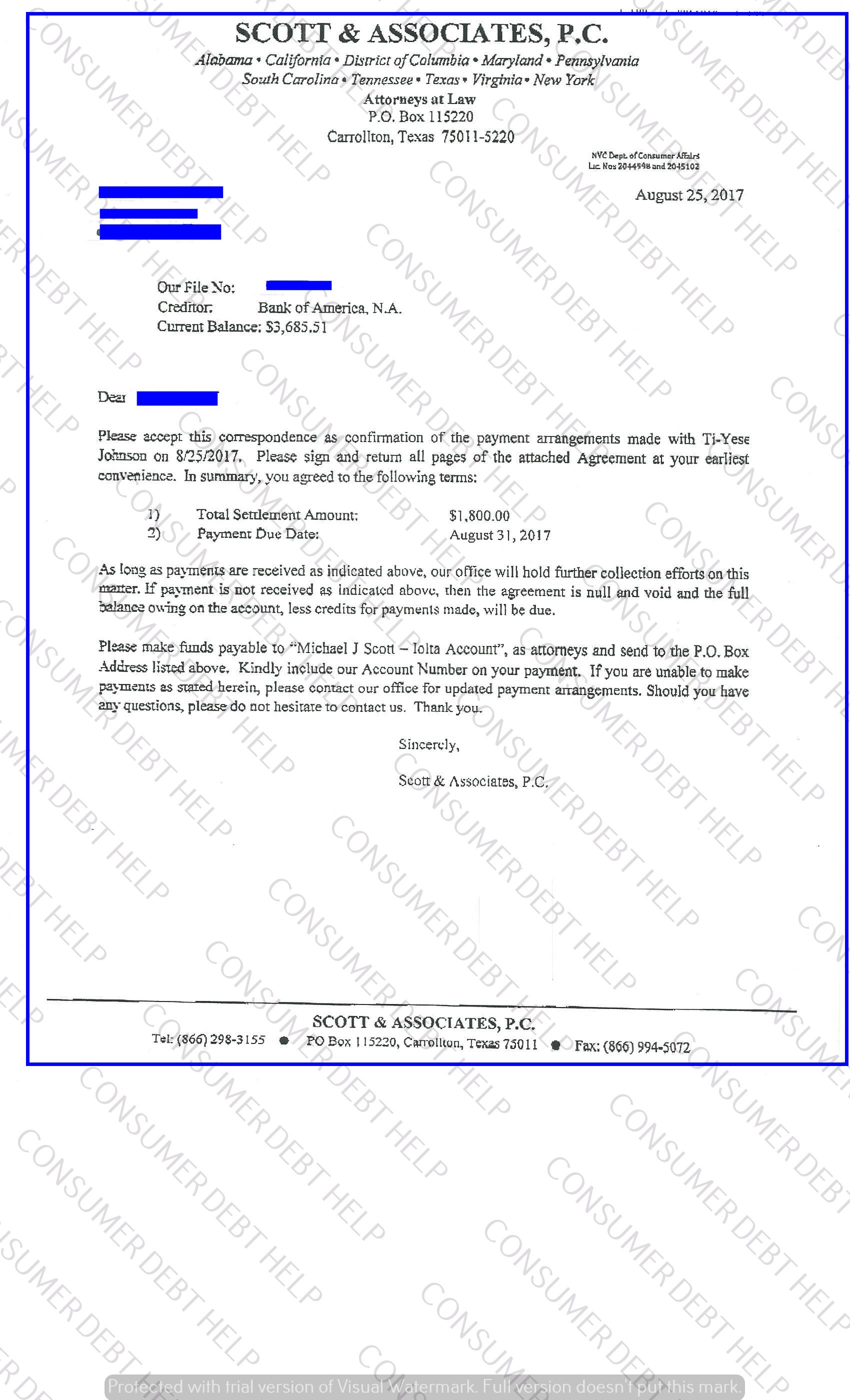

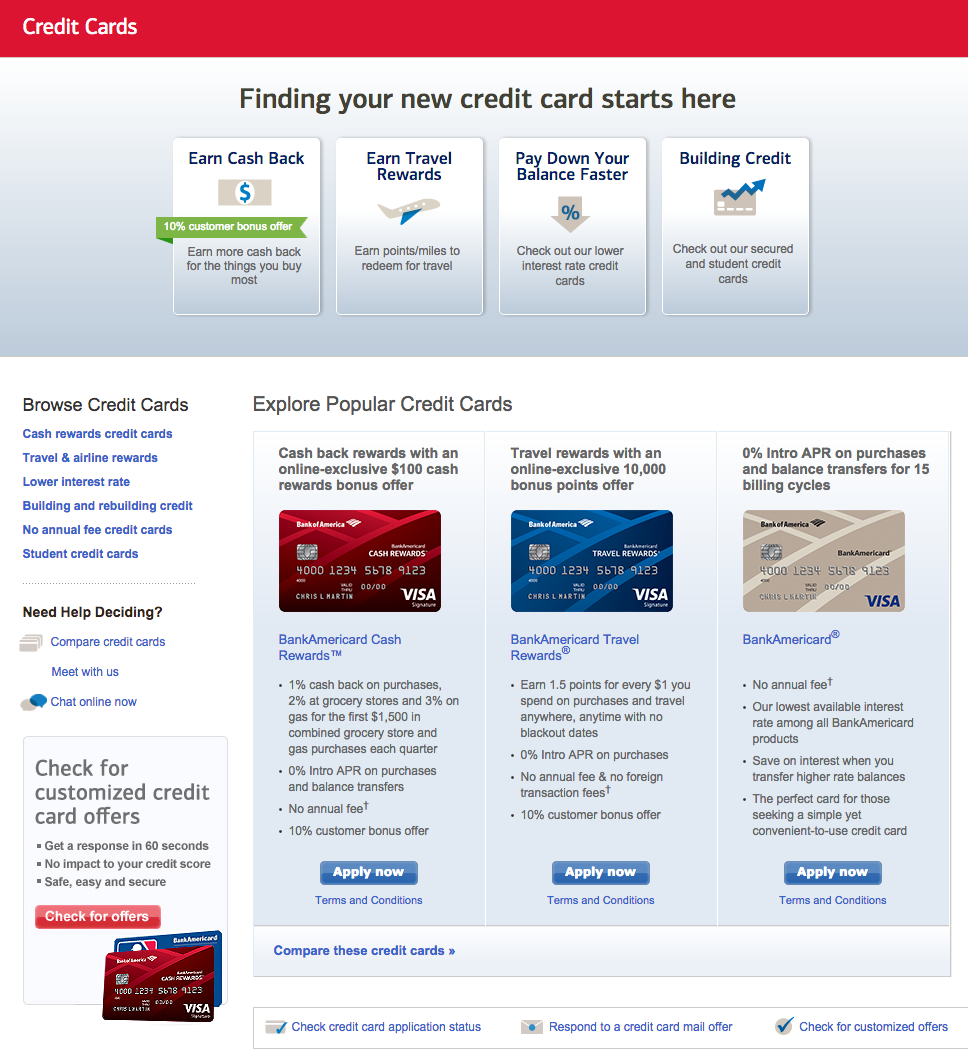

Kindly note that certain products and services are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis. "Bank of America" and "BofA Securities" are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising.

In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. But if this sounds too good to be true, then you're onto something. It requires a sprawling branch network, colossal call centers, sophisticated mobile and online banking platforms, and thousands of ATMs spread across the continent. It's so expensive, in fact, that most large banks actually lose money on the typical customer account. According to research firm Moebs Services, the average checking account cost a bank $349 in 2011. Meanwhile, the average revenue per account was just $268, implying a loss of $81.

In Bank of America's case, if you multiply that out by 40 million, you get $3.24 billion. ¹ Transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic bank account or debit card. Recipients have 14 days to register to receive money or the transfer will be canceled. Merrill Lynch Canada Inc. is registered as an Approved Participant of the Bourse de Montreal.

You may redeem rewards dollars for account credits to be deposited to your First Citizens checking or savings account or applied to your First Citizens credit card, consumer loan or mortgage. Similar in appearance across banks, FDIC-insured deposits, home loans, checking accounts, or debit and credit cards, are a lot more like airline tickets or salt than one-of-a-kind drug discoveries or branded tech gadgets. That's because when a bank hits on a successful product, there's little to stop competitors from copying its idea. Over the last few years, the bank, along with the industry in general, has found itself in the regulatory and legal crosshairs over the litany of fees it charges customers and the way in which it does so.

It's been sued for its overdraft policy of reordering customer transactions in order to maximize overdrafts and forced by regulators to change it, prompting the bank most recently to consider offering a new type of account which prohibits overdrafts altogether. Debit card interchange fees are now capped by the Federal Reserve. And it's been admonished for its treatment of mortgage and credit card holders. You can set up a one-time or recurring direct deposit transfer to the financial institution of your choice at no cost to you. Visit Bank of America Debit Card or call Bank of America debit card customer service at the phone number on the back of your card.

"Bank of America" and "BofA Securities" are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. Deposits with BANA CB are not insured with the Canada Deposit Insurance Corporation. BANA CB shall not impose undue pressure on, or coerce, a person to obtain a product or service from a particular person, including bank and any of its affiliates, as a condition for obtaining another product or service from BANA CB. Banking, credit card, automobile loans, mortgage and home equity products are provided by Bank of America, N.A. And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

Programs, rates, terms and conditions are subject to change without notice. We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that. Businesses may redeem reward dollars for cash back to a First Citizens checking or savings account or credit card statement credits and Pay Me Back statement credits. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and 16,000 ATMs and more than 4,700 branches.

But Bank of America tried this in 2011 with the introduction of a $5-per-month debit card fee, and was forced to abandon the attempt months later after uproar among its customers and consumer advocates contributed to, among other things, Bank Transfer Day. Indeed, since Washington Mutual, the former savings and loan colossus acquired by JPMorgan in 2008, introduced free checking in the mid-1990s, this approach has been a nonstarter. As the Exclusive Banking Partner of the Kansas City Chiefs, we want to give all of Kansas City the opportunity to bank like a champion.

Our Chiefs Checking is a free checking account with cheer-worthy perks like 1% cash back8 on the first $500 of monthly purchases, an exclusive Visa® Chiefs debit card, discounts at the Chiefs Pro Shop and more. With Business Banking, you'll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. Bank of America announced several relief measures for small businesses and consumers, including deferred payments on credit cards, auto loans and mortgages as well as refunds for checking account fees.

Requests for refunds and deferrals are handled on a case-by-case basis, the bank said in a statement late on Thursday. Second, banks know that customers think it's a logistical and financial hassle to switch to another bank. Customers who feel locked into a relationship are less likely to leave when a bank treats them poorly. The banking industry has thus been forced to become more creative in its attempt to offset these losses. Much like the fees that spawned in the wake of Southwest Airlines' and other discounters' disruption of the airline industry, Bank of America has gravitated toward less transparent means to recoup the deficit. Instead of baggage fees, it charges overdraft and non-sufficient funds fees.

As opposed to charging you for a can of soda, it takes a tiny proportion of every debit or credit card transaction that it processes for customers. In the third quarter of this year alone, it generated $2.5 billion from various noninterest charges in its consumer banking division. Bank of America can assist you with a domestic emergency cash transfer if you need cash from your debit card immediately, such as if your card is lost or you are still waiting for your card to arrive in the mail. You can speak with a Bank of America customer representative by calling one of the phone numbers listed in the Additional Information section of this page. Visit Bank of America's website and select Fee Information for information about emergency cash transfer fees.

Affiliates of Bank of America may make a market or deal as principal in the securities mentioned in these Sites or in options based thereon. In addition, Bank of America or its Affiliates, their shareholders, directors, officers and/or employees, may from time to time have long or short positions in such securities or in options, futures or other derivative instruments based thereon. One or more directors, officers and/or employees of Bank of America or its Affiliates may be a director of the issuer of the securities mentioned at these Sites.

Also, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill Account Access. These ads are based on your specific account relationships with us. To check your rewards points balance and cash in or redeem your rewards points online, sign in to Online Banking and select your credit card then select the Rewards tab. Also, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as "MLPF&S" or "Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation ("BofA Corp."). MLPF&S is a registered broker-dealer, registered investment adviser, Member Securities Investor Protection popup and a wholly owned subsidiary of Bank of America Corporation ("BofA Corp"). The combined balance is calculated based on your average daily balance for a three calendar month period. Certain benefits are also available without enrolling in Preferred Rewards if you satisfy balance and other requirements.

Your benefits become effective within one month of your enrollment, or for new accounts within one month of account opening, unless we indicate otherwise. Please review the applicable Merrill Guided Investing Program Brochure or Merrill Guided Investing with Advisor Program Brochure for information including pricing, rebalancing, and the details of the investment advisory program. Your recommended investment strategy will be based solely on the information you provide to us for this specific investment goal and is separate from any other advisory program offered with us. If there are multiple owners on this account, the information you provide should reflect the views and circumstances of all owners on the account. If you are the fiduciary of this account for the benefit of the account owner or account holder (e.g., trustee for a trust or custodian for an UTMA), please keep in mind that these assets will be invested for the benefit of the account owner or account holder.

Merrill Guided Investing is offered with and without an advisor. Non-deposit investment products, insurance, and securities are NOT deposits or obligations of, insured or guaranteed by Associated Bank, N.A. Or any bank or affiliate, are NOT insured by the FDIC or any agency of the United States, and involve INVESTMENT RISK, including POSSIBLE LOSS OF VALUE. Associated Banc-Corp and its affiliates do not give tax or legal advice. Consult with your tax and/or legal advisor for information specific to your situation. Just take two pictures to deposit your checks directly into your account. Enroll in KeyBank online and mobile banking and download our mobile app today.

Use secure online and mobile banking to deposit checks, pay bills, send money to friends and more. Investment and insurance products and services including annuities are available through U.S. Bancorp Investments, Inc., member FINRA and SIPC, an investment adviser and a brokerage subsidiary of U.S. Cash back and account credit redemptions must be completed through the program website, however a statement credit back to your First Citizens Card can also be redeemed through the First Citizens Rewards Call Center. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you.

Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, memberFINRA and SIPC.

Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Chase Bank serves nearly half of U.S. households with a broad range of products.

Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Switching costs is the same reason some cable companies, whose customers have to pay fees and jump through hoops when they want to cancel service, feel emboldened to provide customer service that's consistently ranked near the bottom of all industries.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as "MLPF&S" or "Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation ("BofA Corp."). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp. Bank of America is an investment bank and financial services provider that operates internationally. It is the second-largest bank in the United States, which means that it gets a lot of calls to its customer service department every day. "Bank of America" is the marketing name for the lending, derivatives and other commercial banking activities of Bank of America Corporation ("BAC"). These activities are performed globally by banking affiliates of BAC and in Australia by Bank of America, N.A. Australian Branch ("BANA Australia").

"BofA Securities" is the marketing name for the securities, corporate advisory and capital markets activities of BAC. These activities are performed in Australia by Merrill Lynch Markets Pty. Limited, Merrill Lynch Futures Limited, Merrill Lynch Equities Limited and their related bodies corporate which hold, or are exempt from the requirement to hold, an Australian Financial Services Licence. Apart from BANA Australia, none of the other BAC entities including BAC itself is an Authorised Deposit-taking Institution authorised under the Banking Act 1959 of Australia regulated by the Australian Prudential Regulation Authority. The obligations of BAC entities do not represent deposits or other liabilities of BANA Australia and are not guaranteed by BANA Australia.

If you select to receive the SafePass code via your mobile number, you are consenting to receive an automated text message. UBS is a global firm providing financial services to private, corporate and institutional clients. We are present in all major financial centers and have offices in over 50 countries.

In Israel, we offer wealth management and securities services. At CommunityAmerica, we're dedicated to the financial well-being of both our members and community. It's this commitment that drives us to share our profits with our members, to participate in the Paycheck Protection Program to help local businesses through challenging times and to support local nonprofit organizations making an impact in our area. As your truly local credit union, we are proud to be your trusted banking partner. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. This and other information may be found in each fund's prospectus or summary prospectus, if available.

Always read the prospectus or summary prospectus carefully before you invest or send money. Merrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge® Self-Directed brokerage account. Brokerage fees associated with, but not limited to, margin transactions, special stock registration/gifting, account transfer and processing and termination apply. Cash back and account credit redemptions must be completed through the Program website, however a statement credit back to your First Citizens Card can also be redeemed through the First Citizens Rewards Call Center. Bank of America appears both unwilling and unable to address the causes of its reputational risks through improved practices and serving customers. Without sound practices, multibillion-dollar legal costs are lurking behind every corner.

And without customer service, the company is vulnerable to disruption. Be sure to read all information including fees for the debit card. For digital wallets, view the Digital Account Fees and Disclosures .

Careful use of this card will help you avoid unnecessary fees. Keep track of your debit card payments and balance information by downloading the Bank of America Prepaid Card app from any app store. Payment information is updated daily and is available through yourUI Onlineor SDI Online account or by calling one of the toll-free numbers provided on Contact EDD. If you have never had a debit card from the EDD before, Bank of America will mail you a card after your first benefit payment has been issued by the EDD . It can take 7 to 10 business days to receive your card in the mail. Please review the Personal Schedule of Fees for your state, also available at your local financial center.

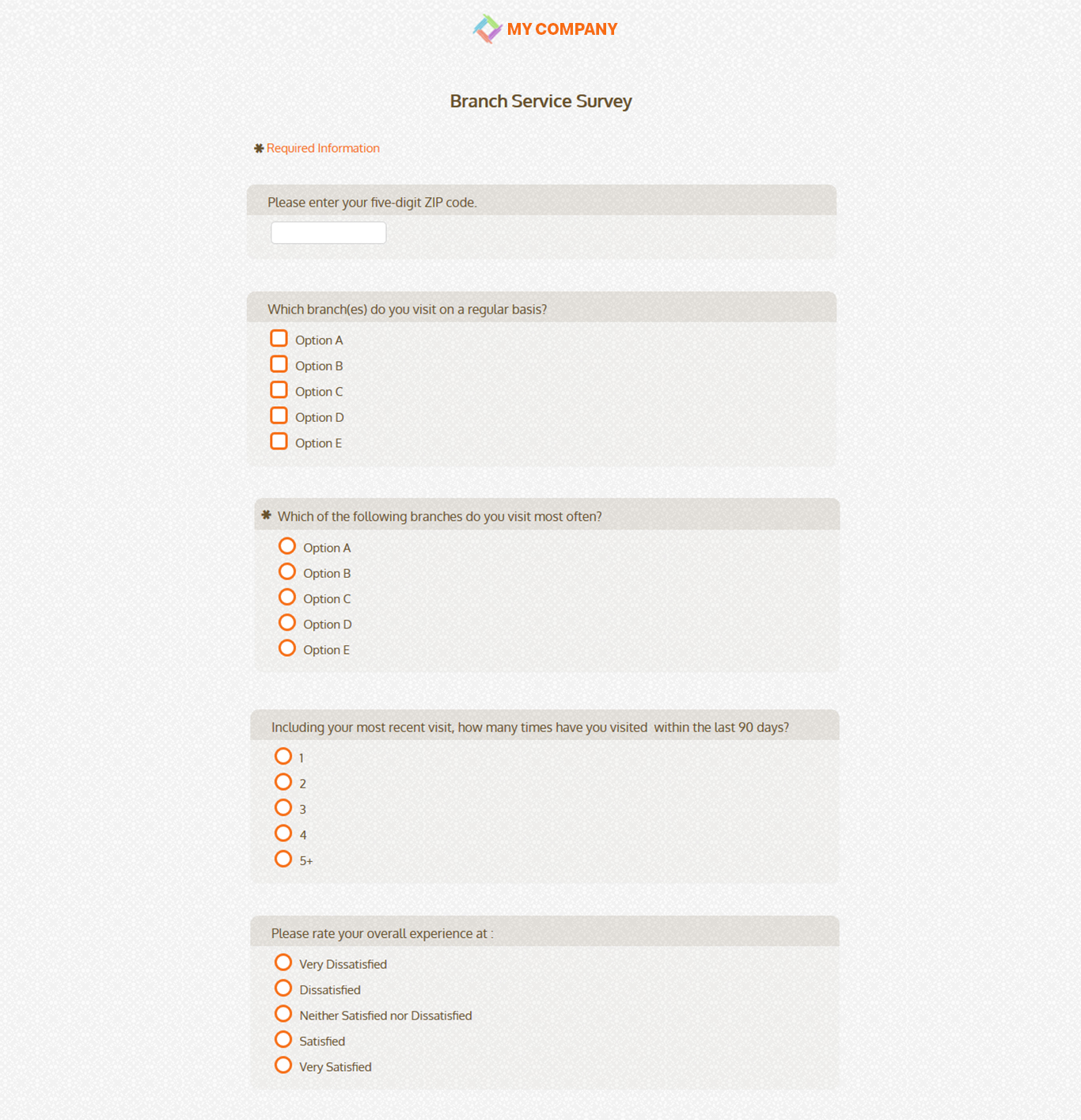

You can also review our FAQs about fees or the credit card agreement you received when you opened your account. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs. Our customer service representatives are ready to answer your questions. Representatives specialize in different topics, so please visit our contact us page and select the topic you'd like to discuss. You can also review our page of help links to find the answers you're looking for online.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.